ثروة كابيتال

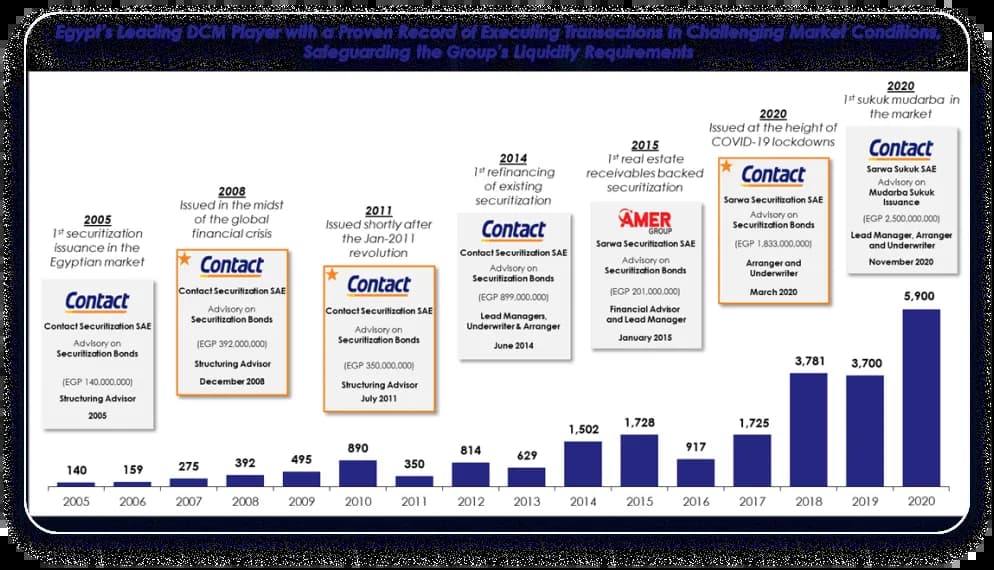

لطالما كان الاستثمار في أسواق رأس مال الدين (DCM) محورا مركزيا لنموذج أعمال ثروة حيث سمح لنا بتنوع قاعدة تمويلنا وإعادة هيكلة عملياتنا بنجاح. ومن خلال خبراتنا من هذه التجربة العميقة الجذور في مجال ادارة أسواق الدين ، قمنا بتسويق مجموعة من خدمات التمويل التي دفعتنا إلى أن نصبح أكبر لاعب في مصر في هذا القطاع. وقد قامت ثروة بترتيب وإصدار أكثر من 26 مليار جنيه من إصدارات الديون منذ عام 2005، بما في ذلك أول طرح من نوعه لسندات التوريق في السوق المصري. كما أن ثروة هي أول مصدر للصكوك المرخصة في السوق المصرية. يتمتع فريقنا بسجل حافل في هيكلة وتسعير وإصدار التعاملات المالية في ظل تقلبات وظروف السوق الصعبة، بما في ذلك الإصدارات التي تحمل تصنيف AA+ – وهو أعلى تصنيف للكيان غير السيادي في مصر. ولذلك فإننا نفخر بخبرة طويلة في هذه القطاع وشبكة من العلاقات مع المستثمرين غير المصرفيين والخبراء وهيئات التصنيف وغيرها من المؤسسات المالية. كما نعمل بوتيرة ثابتة مع هيئات التصنيف والبنوك الرائدة من خلال منحها إمكانية الوصول اليومي والاطلاع على عملياتنا وقاعدة بياناتنا وهو امر نفخر به ويدعم الإصدارات التي نطرحها بمزيد من الثقة والشفافية . بالإضافة الى الخبرة في مجموعة واسعة من فئات الأصول التي تتراوح بين قروض السيارات والمستحقات العقارية فإننا نعمل ايضاً بنشاط على توسيع خبرتنا لزيادة هياكل التمويل الجديدة والمبتكرة.

المعاملات الهامة التي نفخر بها:

- أول طرح للسندات بالسوق المصري في عام 2005

- أول طرح للسندات بالدعم العقاري في عام 2015.

- أول طرح صكوك مضاربة لمؤسسة مالية في 2020

رأيك يهمنا